LENDING

Boost Connect offers lending products in partnership with Boost Credit to serve the underserved population in the region. These tailored financial solutions are specifically designed for small businesses, distributors, and merchants who often face difficulties in accessing credit and financing from traditional financial institutions.

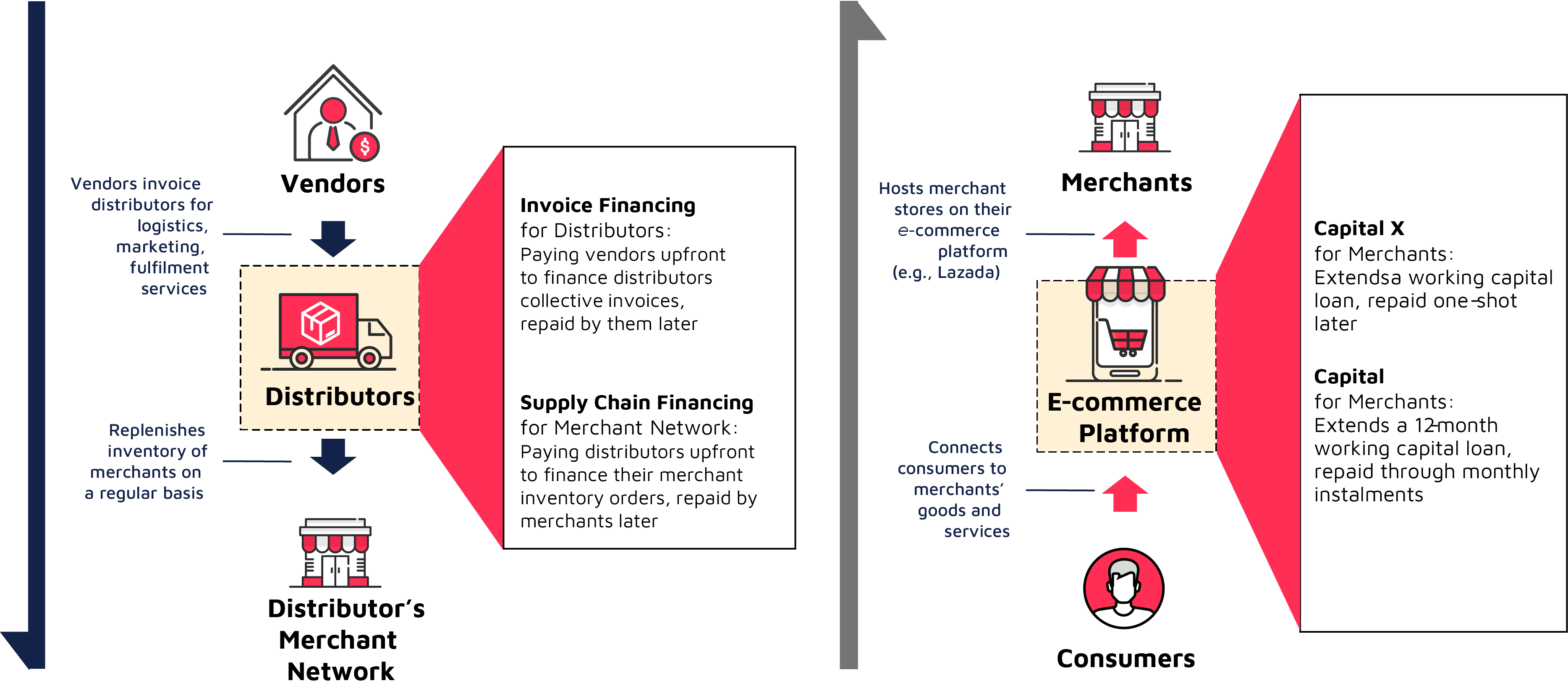

The lending solution include:

- Invoice Financing for Distributors: Distributors can finance their invoices by paying vendors upfront, helping them manage their cash flow effectively.

- Supply Chain Financing for Merchant Network: This option provides upfront financing to distributors for financing their merchant inventory orders, ensuring smooth operations

- Capital X for Merchants: We offer working capital loans to small businesses, enabling them to meet their short-term cash flow needs efficiently.

- Capital for Merchants: This solution provides a 12-month working capital loan to small businesses, with repayment through monthly installments.

We help businesses, help their network off customers:

Illustrative example of how we serve our client